The semiconductor sector continues to expand, fueled by accelerating artificial intelligence (AI) adoption, growing data center capacity, and sustained investment in advanced manufacturing.

Within this backdrop, Lam Research Corporation (LRCX) has emerged as a key beneficiary, uniquely positioned to capture the long-term growth from AI-driven semiconductor demand that Bank of America Corporation (BAC) analysts expect to persist through 2026 and beyond.

BofA frames 2026 as the midpoint of an “8–10 year journey,” where traditional IT infrastructure upgrades are driving accelerated computing and AI workloads. This sets a multi-year growth runway for equipment suppliers like Lam Research.

The bank projects the semiconductor industry to grow roughly 30% toward its first $1 trillion in global sales in 2026, with wafer fab equipment (WFE) sales expanding at nearly double-digit year-over-year (YOY) rates as fabs invest in capacity and advanced process technologies. Further, another robust year is anticipated, with over 50% growth in AI semiconductor sales, supported by high data center utilization, tight supply, enterprise AI adoption, and intense competition among LLM builders, hyperscale cloud providers, and sovereign clients.

Let's discover why Lam Research is being highlighted as one of BofA’s top semiconductor stocks for 2026, alongside NVIDIA Corporation (NVDA) and Broadcom (AVGO), positioned to capture demand across key AI and semiconductor segments.

About Lam Research Stock

Fremont, California-based Lam Research designs, manufactures, markets, refurbishes, and services advanced semiconductor processing equipment critical to integrated circuit fabrication.

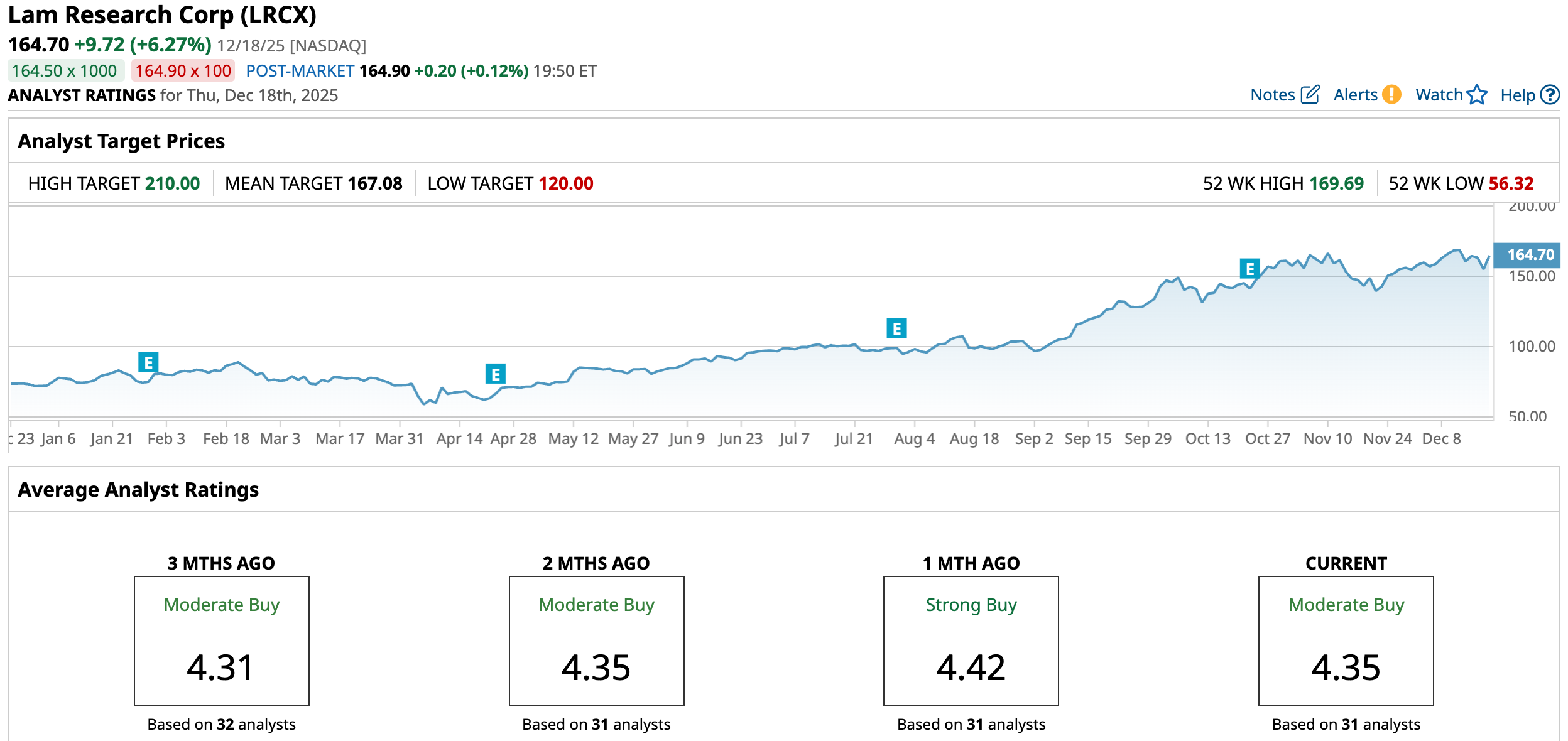

With a market cap of nearly $194.7 billion, Lam Research’s scale is clearly reflected in its stock performance. Its shares have jumped 119% over the past 52 weeks, with a recent three-month surge of 30.38%, highlighting robust momentum fueled by sustained AI-driven semiconductor expansion and continued chip demand growth.

Valuation metrics show LRCX stock is currently trading at 34.08 times forward adjusted earnings and 9.15 times sales, marking a premium to industry averages. It reflects investor confidence in Lam’s prospects.

Moreover, Lam Research rewards shareholders through steady dividends, maintaining an 11-year streak. It pays an annual $1.04 dividend, yielding 0.64%, with the most recent $0.26 installment scheduled for Jan. 7, 2026, to shareholders of record as of Dec. 3.

Lam Research Surpasses Q1 Earnings

On Oct. 22, Lam Research surprised Wall Street with Q1 fiscal 2026 results. Revenue jumped 27.7% YOY to $5.32 billion, beating the $5.24 billion forecast, while adjusted EPS came in at $1.26, topping expectations of $1.22. Strong demand for AI-driven semiconductor equipment and high-bandwidth memory investments spurred growth, sending the stock up nearly 4.5% in the following session.

Lam promoted both expansion and efficiency. The gross margin for the September quarter was at the upper end of management guidance at 50.6%, up from 50.3% in June. The operating margin reached 35%, which also came in more than anticipated.

Additionally, the firm improved its financial flexibility by retaining $6.7 billion in cash and equivalents at the end of September, up from $6.4 billion in June. Looking ahead, management anticipates that demand for AI data centers will create market opportunities worth billions of dollars, giving Lam an opportunity to increase its market share.

In the face of strong market trends, they anticipate sales of $5.2 billion ± $300 million, a gross margin of 48.4% ± 1%, and an EPS of $1.15 ± $0.10 for December 2025.

Meanwhile, analysts see Q2 fiscal year 2026 EPS rising 27.5% YOY to $1.16. They forecast full-year fiscal 2026 earnings growing 15.7% to $4.79 and anticipate fiscal 2027 EPS climbing 16.3% to $5.57.

What Do Analysts Expect for Lam Research Stock?

Wall Street analysts maintain strong confidence in Lam Research’s stock. Bernstein’s Stacy Rasgon reaffirmed a “Buy” rating with a $175 price target, signaling belief in Lam’s ability to capitalize on AI-driven semiconductor demand.

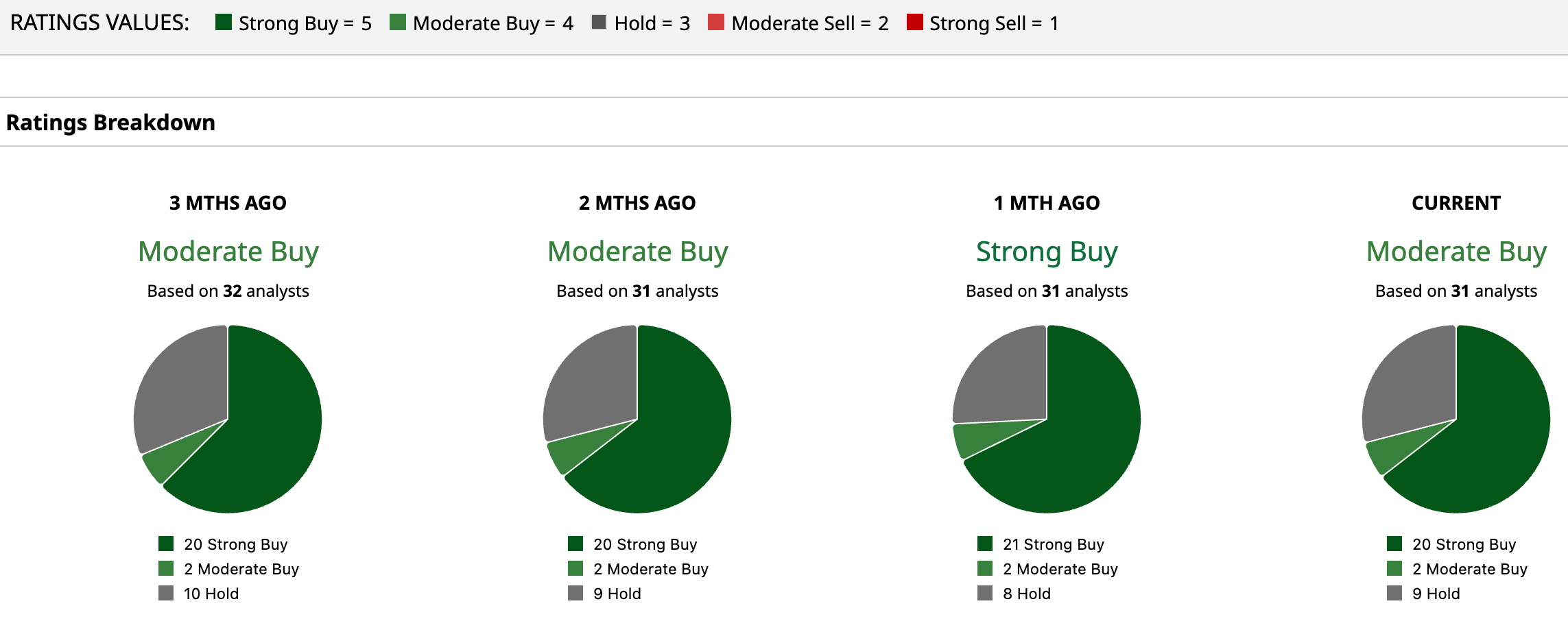

LRCX stock carries an overall “Moderate Buy” consensus rating, reflecting broad conviction in its growth and execution. Out of 31 analysts covering the stock, 20 rate it “Strong Buy,” two assign “Moderate Buy,” and nine recommend “Hold.”

The stock’s average price target of $167.08 represents marginal potential upside. Meanwhile, the Street-high target of $210 from Jefferies analyst Blayne Curtis implies potential gain of 27.5% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CubeSmart Just Raised Its Dividend. Should You Buy CUBE Stock Here?

- 1 Analyst Is Betting on 73% Upside Potential for D-Wave Quantum Stock. Should You Buy QBTS Shares Here?

- This 1 Lesser-Known Stock Is Set to Dominate with Nvidia and Broadcom in 2026

- This Flying Car Stock Just Announced a Major Production Update. Should You Buy Shares for 2026?