Selective Insurance Group has been treading water for the past six months, recording a small loss of 2.1% while holding steady at $83.20. The stock also fell short of the S&P 500’s 13.9% gain during that period.

Is there a buying opportunity in Selective Insurance Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Selective Insurance Group Not Exciting?

We're cautious about Selective Insurance Group. Here are three reasons we avoid SIGI and a stock we'd rather own.

2. Recent EPS Growth Below Our Standards

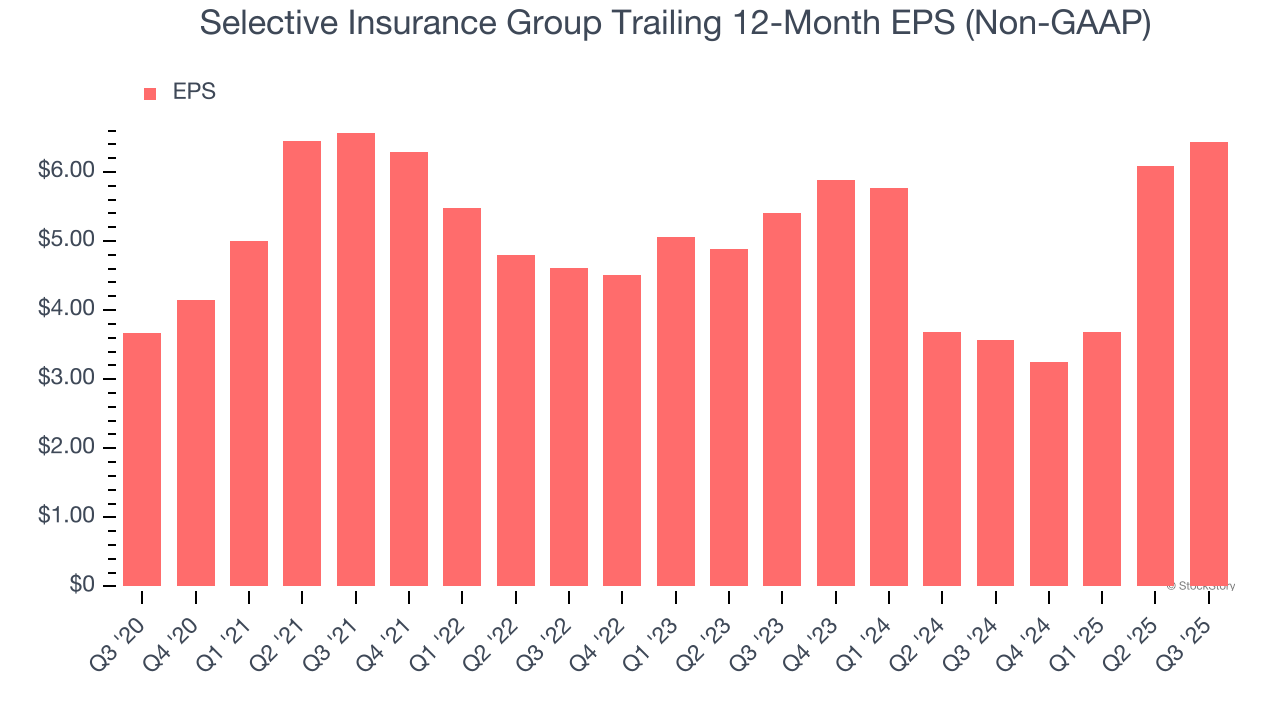

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Selective Insurance Group’s EPS grew at a weak 9.2% compounded annual growth rate over the last two years, lower than its 13.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Steady Increase in BVPS Highlights Solid Asset Growth

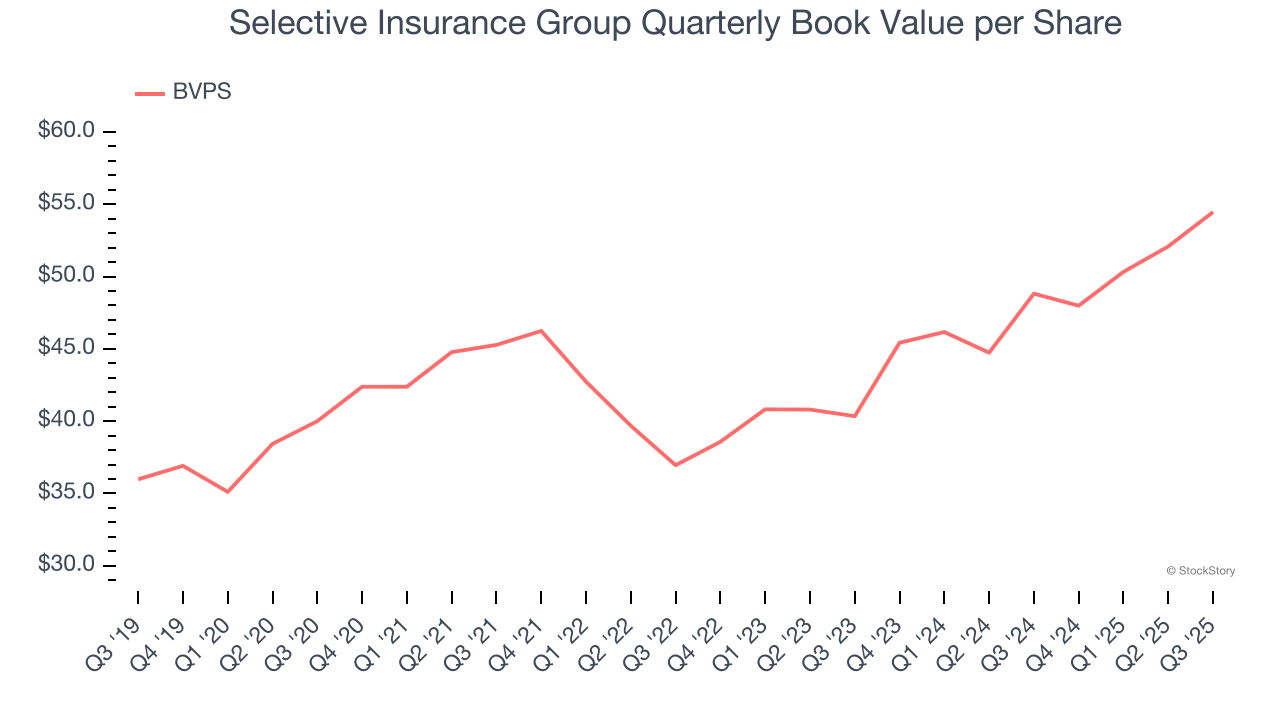

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Although Selective Insurance Group’s BVPS increased by a meager 6.4% annually over the last five years, the good news is that its growth has recently accelerated as BVPS grew at a solid 16.2% annual clip over the past two years (from $40.35 to $54.46 per share).

Final Judgment

Selective Insurance Group isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 1.5× forward P/B (or $83.20 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Selective Insurance Group

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.