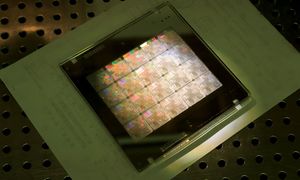

NVIDIA Corp (NVDA)

191.13

-1.38 (-0.72%)

NASDAQ · Last Trade: Feb 1st, 6:42 PM EST

FLXR is an actively managed ETF providing diversified exposure to global fixed income markets through a flexible, multi-sector approach.

Via The Motley Fool · February 1, 2026

Wintrust Financial operates a diversified banking and specialty finance business across the Midwest and select Florida markets.

Via The Motley Fool · February 1, 2026

Focused on ultra-short U.S. Treasury exposure, VBIL targets liquidity and capital preservation for institutional and individual investors.

Via The Motley Fool · February 1, 2026

Nvidia's infusion supports a major customer, but CoreWeave still has debt.

Via The Motley Fool · February 1, 2026

AI infrastructure spending could eclipse $500 billion this year.

Via The Motley Fool · February 1, 2026

AMD is excited about its growth prospects for 2026.

Via The Motley Fool · February 1, 2026

Billionaires regularly pile more of their money into the biggest winners.

Via The Motley Fool · February 1, 2026

Taiwan Semiconductor Manufacturing looks like an AI top performer.

Via The Motley Fool · February 1, 2026

Prologis can make a lot of money developing AI data centers over the coming decade.

Via The Motley Fool · February 1, 2026

There are plenty of strong growth and value stocks available to buy right now.

Via The Motley Fool · February 1, 2026

Advanced Micro Devices is swiftly becoming a major source of parallel processing power for hyperscalers.

Via The Motley Fool · February 1, 2026

Nvidia and CoreWeave have a close relationship.

Via The Motley Fool · February 1, 2026

Technology stocks are likely to continue leading the broader market higher in 2026, fueled by the artificial intelligence boom.

Via The Motley Fool · February 1, 2026

As of February 1, 2026, the global financial landscape has been fundamentally rewired by a concept once relegated to the fringes of crypto-economic theory: Information Finance, or "InfoFi." What began as a tool for political junkies to hedge election risks has evolved into the world’s most potent data transmission mechanism. Prediction markets have transitioned from [...]

Via PredictStreet · February 1, 2026

Micron stock has gained 327% over the last 12 months thanks to soaring demand for memory from data center operators.

Via The Motley Fool · February 1, 2026

The traditional news ticker is undergoing a radical transformation. As of February 1, 2026, the familiar crawl of stock prices and weather updates has been joined—and in some cases replaced—by a far more dynamic metric: real-time "wisdom of the crowd" probabilities. From the halls of the U.S. Congress to the red carpets of Hollywood, prediction [...]

Via PredictStreet · February 1, 2026

Nvidia CEO Jensen Huang warns that young adults today are too informed and cynical, lacking the time for optimism and resilience.

Via Benzinga · February 1, 2026

Nvidia's stock is set to crush the market again in 2026.

Via The Motley Fool · February 1, 2026

It's built to flourish with or without current AI hype.

Via The Motley Fool · February 1, 2026

This ETF has tech companies leading the way with a built-in hedge.

Via The Motley Fool · February 1, 2026

CoreWeave could quadruple its revenue in the next two years.

Via The Motley Fool · February 1, 2026

Nancy Pelosi’s $5 million Disney sale contrasts with insider buying and a 23% analyst upside case, leaving DIS looking more like a slowly improving restructuring story than a broken business.

Via Barchart.com · February 1, 2026

Microsoft, Apple, and Meta posted strong earnings fueled by cloud and iPhone demand, while DeepSeek pivoted to Nvidia's AI chips and OpenAI entered talks to raise nearly $40 billion from major tech partners.

Via Benzinga · February 1, 2026

A cheap valuation and stunning growth make this AI stock worth buying hand over fist before it soars higher.

Via The Motley Fool · February 1, 2026

The Vanguard Information Technology ETF gives investors positions in leading tech companies, but it comes with risk.

Via The Motley Fool · February 1, 2026