Cummins (CMI)

578.82

-5.12 (-0.88%)

NYSE · Last Trade: Feb 1st, 2:53 PM EST

Detailed Quote

| Previous Close | 583.94 |

|---|---|

| Open | 575.19 |

| Bid | 564.86 |

| Ask | 578.81 |

| Day's Range | 569.93 - 583.82 |

| 52 Week Range | 260.02 - 592.53 |

| Volume | 996,675 |

| Market Cap | 83.12B |

| PE Ratio (TTM) | 29.98 |

| EPS (TTM) | 19.3 |

| Dividend & Yield | 8.000 (1.38%) |

| 1 Month Average Volume | 838,719 |

Chart

About Cummins (CMI)

Cummins is a global leader in the design and manufacture of engines and power generation equipment. The company specializes in providing advanced diesel and alternative fuel engines for a wide range of applications, including commercial vehicles, construction and agriculture, and industrial markets. Cummins also offers a variety of related products and services, such as filtration systems, emission solutions, and power generation technologies, focusing on sustainability and innovation to meet the evolving energy demands of customers worldwide. Through its commitment to research and development, Cummins plays a key role in driving advancements in engine efficiency, performance, and environmental stewardship. Read More

News & Press Releases

Large-cap stocks are known for their staying power and ability to weather market storms better than smaller competitors.

However, their sheer size makes it more challenging to maintain high growth rates as they’ve already captured significant portions of their markets.

Via StockStory · January 29, 2026

Caterpillar Inc. (NYSE:CAT) stunned Wall Street today, January 29, 2026, by reporting a record-breaking $19.1 billion in quarterly revenue, an 18% jump that blew past analyst expectations. The surge in sales was powered by an unprecedented wave of demand for heavy machinery and industrial power solutions, particularly those

Via MarketMinute · January 29, 2026

As of January 28, 2026, PACCAR Inc (NASDAQ: PCAR) stands at a pivotal crossroads between industrial tradition and a high-tech future. For over a century, the Bellevue-based manufacturer has been the "gold standard" of the heavy-duty truck market, known primarily for its premium Kenworth, Peterbilt, and DAF brands. However, the conversation surrounding PACCAR in early [...]

Via Finterra · January 28, 2026

Cummins Inc. (NYSE:CMI) Passes Key Dividend, Earnings, and Financial Health Filterschartmill.com

Via Chartmill · January 27, 2026

Via Benzinga · January 26, 2026

As we look back from the vantage point of January 2026, the financial landscape of 2024 stands as a watershed moment in economic history. It was the year that corporate America finally broke the traditional bond between profit growth and payroll expansion, ushering in what economists now call the "Jobless

Via MarketMinute · January 23, 2026

As the first month of 2026 draws to a close, the dust is only beginning to settle on one of the most volatile periods in recent corporate history. Throughout 2025, a cloud of "unquantifiable uncertainty" hung over the balance sheets of the world’s largest companies. As of January 23,

Via MarketMinute · January 23, 2026

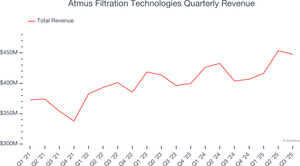

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the gas and liquid handling industry, including Atmus Filtration Technologies (NYSE:ATMU) and its peers.

Via StockStory · January 22, 2026

Applied Digital APLD Q2 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

Applied Digital APLD Q4 2024 Earnings Transcript

Via The Motley Fool · January 22, 2026

Applied Digital APLD Q1 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

With expanded services from EDP Automotive, Victoria, BC fleet owners seeking qualified mechanics for light duty diesel trucks can now access the expertise of a locally based team.

Via Press Release Distribution Service · January 21, 2026

QICHENG extends w arm est New Year's greetings to all friends and partners. Looking back on the fruitful year of 2025, we are filled with gratitude.The past year has been one of collaborative growth and significant achievement. Every milestone we reached was made possible by your steadfast trust, invaluable support, and close partnership.

Via AB Newswire · January 19, 2026

As of January 19, 2026, Caterpillar Inc. (NYSE: CAT) stands as the undisputed titan of the Dow Jones Industrial Average, capping off a historic 12-month run that saw its share price surge nearly 62%. Once viewed primarily as a barometer for global construction and mining, the company has successfully rebranded

Via MarketMinute · January 19, 2026

Movers and shakers in today's after-hours session for S&P500 stocks?chartmill.com

Via Chartmill · January 19, 2026

While profitability is essential, it doesn’t guarantee long-term success.

Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

Via StockStory · January 18, 2026

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the gas and liquid handling stocks, including Graco (NYSE:GGG) and its peers.

Via StockStory · January 18, 2026

Applied Digital Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 15, 2026

Filtration products manufacturer Atmus Filtration Technologies (NYSE:ATMU) announced better-than-expected revenue in Q3 CY2025, with sales up 10.9% year on year to $447.7 million. Its non-GAAP profit of $0.69 per share was 15.1% above analysts’ consensus estimates.

Via StockStory · January 15, 2026

Halper Sadeh LLC, an investor rights law firm, is investigating whether certain officers and directors of Cummins Inc. (NYSE: CMI) breached their fiduciary duties to shareholders.

By Halper Sadeh LLC · Via Business Wire · January 15, 2026

Applied Digital's fourth quarter was marked by strong revenue growth and a positive market reaction, with results exceeding Wall Street expectations. Management credited the rapid energization of the Polaris Forge 1 data center, which began generating lease revenues ahead of schedule, as a key driver. CEO Wes Cummins highlighted the completion of the first of three contracted buildings for CoreWeave and the signing of a major lease with a U.S.-based hyperscaler as instrumental milestones. The company also benefited from robust demand for high-performance computing infrastructure, particularly for artificial intelligence and cloud workloads. Management emphasized that modular, efficient construction and access to low-cost energy in the Dakotas provided a competitive advantage.

Via StockStory · January 14, 2026

The past six months have been a windfall for Cummins’s shareholders. The company’s stock price has jumped 66.8%, setting a new 52-week high of $567.59 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Via StockStory · January 13, 2026

Applied Digital is soaring impressively in 2026 already, but can it deliver more gains?

Via The Motley Fool · January 13, 2026

Caterpillar Inc. (NYSE: CAT) has long been the primary barometer for the global construction and mining industries, but in early 2026, the industrial giant has found a new, high-voltage catalyst: the artificial intelligence revolution. As of January 13, 2026, Caterpillar’s stock has surged into a fresh technical "buy zone"

Via MarketMinute · January 13, 2026