Intercontinental Exchange (ICE)

157.22

-7.59 (-4.61%)

NYSE · Last Trade: Feb 11th, 12:40 PM EST

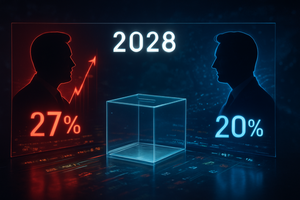

As the United States settles into the second year of the second Trump administration, the political world is already looking toward the horizon. While the 2026 midterms are the immediate hurdle, prediction markets are buzzing with high-stakes activity surrounding the 2028 Presidential Election. The early favorites have emerged with startling clarity: Vice President JD Vance [...]

Via PredictStreet · February 9, 2026

The digital asset landscape witnessed a seismic shift this week as Bullish (NYSE: BLSH), the institutional-grade crypto exchange, reported an explosive 70% year-over-year revenue growth in its latest quarterly earnings. Propelled by the meteoric rise of its newly launched options trading platform and a calculated expansion into the United States,

Via MarketMinute · February 9, 2026

Intercontinental Exchange Inc (NYSE:ICE) Edges Past Q4 2025 Estimates, Provides Measured 2026 Outlookchartmill.com

Via Chartmill · February 5, 2026

As the prediction market industry enters its most volatile and high-stakes year to date, the internal rivalry between the sector’s two largest titans has spilled over into the markets themselves. On Manifold Markets, a high-liquidity "meta-market" titled "Top 1 prediction market by volume in 2026?" has become the primary scoreboard for what insiders are calling [...]

Via PredictStreet · February 8, 2026

The prediction market landscape shifted significantly this week as the world’s leading forecasting platform, Polymarket, officially commenced its transition to native USDC for on-chain settlement. In a strategic partnership with Circle Internet Group (NYSE: CRCL), the move marks the definitive end of the "bridged asset" era for the platform, replacing the older, more vulnerable USDC.e [...]

Via PredictStreet · February 8, 2026

While the dust of the 2024 election has long since settled, the gaze of the political and financial worlds has already shifted toward the next horizon. As of February 7, 2026, prediction markets for the 2028 Democratic Nominee have reached an unprecedented level of early activity. On Kalshi, the premier regulated event contract exchange, the [...]

Via PredictStreet · February 7, 2026

The landscape of global finance shifted permanently this winter as the Intercontinental Exchange (NYSE: ICE) finalized a staggering $2 billion strategic investment into Polymarket. For years, prediction markets were viewed as the "Wild West" of decentralized finance—a niche playground for crypto-natives and political junkies. However, with the backing of the world’s most powerful exchange operator, [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the intersection of high finance and political power has reached a new frontier. The Trump family, led by Donald Trump Jr., has successfully pivoted from the political arena into the bedrock of the global "Information Finance" (InfoFi) movement. With strategic advisory roles at the industry’s two largest platforms, Kalshi and [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the prediction market landscape has officially transitioned from a niche corner of the internet into a high-stakes battleground for global financial supremacy. Dubbed "The Great Prediction War of 2026," the industry is currently witnessing an unprecedented clash between the decentralized heavyweight Polymarket and the federally regulated Kalshi. At the center [...]

Via PredictStreet · February 6, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.8% year on year to $2.50 billion. Its non-GAAP profit of $1.71 per share was 2.2% above analysts’ consensus estimates.

Via StockStory · February 6, 2026

In a move that signals the complete integration of digital assets into the global financial architecture, CME Group (NASDAQ: CME) has announced the expansion of its cryptocurrency derivatives suite to include Cardano (ADA), Chainlink (LINK), and Polkadot (DOT). The launch, set to take place on February 9, 2026, is paired

Via MarketMinute · February 5, 2026

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

As the Federal Reserve's March 2026 meeting approaches, a striking divergence has emerged between traditional financial instruments and the burgeoning world of "Information Finance." On Kalshi, the federally regulated prediction market, traders are increasingly convinced that the central bank will pivot toward easing. Currently, 64% of participants on the platform are betting on a 25-basis-point [...]

Via PredictStreet · February 5, 2026

The global financial landscape has shifted into a new era of "Information Finance," or InfoFi, where the most valuable commodity is not gold or oil, but the "truth." As of February 5, 2026, the battle for dominance in this sector has narrowed down to two titans: Polymarket, the decentralized, crypto-native pioneer, and Kalshi, the regulated, [...]

Via PredictStreet · February 5, 2026

The prediction market industry has officially shed its label as a niche corner of the internet for political junkies and sports bettors. As of early February 2026, the sector is celebrating a watershed moment: total trading volume surpassed a staggering $45 billion in 2025, a nearly five-fold increase from the previous year. This momentum shows [...]

Via PredictStreet · February 5, 2026

ICE Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 5, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 35.3% year on year to $3.14 billion. Its non-GAAP profit of $1.71 per share was 2.2% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) will be reporting earnings this Thursday before market open. Here’s what to expect.

Via StockStory · February 3, 2026

SiteOne Landscape Supply distributes a broad range of landscape products to professional customers across North America.

Via The Motley Fool · February 3, 2026

BellRing Brands markets protein shakes and powders through Premier Protein and Dymatize, serving health-conscious consumers globally.

Via The Motley Fool · February 3, 2026

Serving bookmakers and media worldwide, Sportradar delivers sports data, analytics, and streaming solutions across the betting value chain.

Via The Motley Fool · February 3, 2026

The concept of "Information Finance," or InfoFi, has transitioned from a niche crypto-economic theory into a foundational pillar of global finance and media. As of February 2, 2026, prediction markets are no longer viewed as mere platforms for speculation; they have been repositioned as sophisticated data-transmission mechanisms that assign a market price to the accuracy [...]

Via PredictStreet · February 2, 2026

As the calendar turns to February 2026, the United States is bracing for a political showdown that promises to be as much a financial event as a democratic one. The 2026 U.S. Midterm Elections are already generating unprecedented activity in the prediction market space, with traders pouring billions of dollars into contracts determining the future [...]

Via PredictStreet · February 2, 2026

The prediction market landscape was forever altered on January 2, 2026, by what traders are now calling the "January 2nd Shockwave." While the industry has long flirted with mainstream relevance, this single day of unprecedented institutional-sized trades—triggered by a geopolitical "black swan" and a massive injection of Wall Street capital—has cemented prediction markets as the [...]

Via PredictStreet · February 2, 2026

Polymarket, the prediction market platform that dominated the 2024 global news cycle, has officially entered its next act. In a bold strategic shift finalized in January 2026, the platform has transitioned from a fee-free information hub into a revenue-generating financial infrastructure. This move is headlined by the introduction of up to 3% "taker fees" on [...]

Via PredictStreet · February 2, 2026