Latest News

Netflix’s $83B offer viewed as more certain, WBD signals flexibility.

Via Talk Markets · December 16, 2025

Via Benzinga · December 16, 2025

The oil markets had a negative day today.

Via Talk Markets · December 16, 2025

This thriving AI business has been an unbelievably successful investment in recent years.

Via The Motley Fool · December 16, 2025

Third Point raised its NVIDIA stake to 2.85M shares as Q3 revenue hits $57B and AI chip demand accelerates for Blackwell and Rubin platforms.

Via Benzinga · December 16, 2025

Lower oil prices will calm inflation fears. That gives the Fed more room to cut rates.

Via Talk Markets · December 16, 2025

Via Benzinga · December 16, 2025

Tesla Hits All-Time High On Robotaxi Optimism As Wall Street Sees Path To $3T Valuation — Europe Battery Plans Add Tailwindstocktwits.com

Via Stocktwits · December 16, 2025

Lennar Corp (NYSE:LEN) reports financial results for the fourth quarter after the market close on Tuesday. Here's a rundown of the report.

Via Benzinga · December 16, 2025

Shares fell as investors weighed the risks of a potential shift into premium coffee through acquisitions.

Via Stocktwits · December 16, 2025

The new Ford EV strategy is expected to result in an $8.5B pre-tax asset write-down, a $19.5B EBIT impact, and a $5.5B cash loss.

Via Benzinga · December 16, 2025

On Tuesday, U.S. airline stocks rallied after several analysts offered rosy predictions for the industry in 2026.

Via Investor's Business Daily · December 16, 2025

Let's have a look at what is happening on the US markets after the closing bell on Tuesday. Below you can find the top gainers and losers in today's after hours session.

Via Chartmill · December 16, 2025

Xcel Energy Stock Slides Toward 3-Month Lows As Texas Files Lawsuit Over ‘Largest Wildfire’ In State Historystocktwits.com

Via Stocktwits · December 16, 2025

Via Benzinga · December 16, 2025

Elon Musk outlines a future where artificial intelligence and robotics reshape work, abundance, and human purpose amid accelerating technological change.

Via Barchart.com · December 16, 2025

The Bank for International Settlements (BIS) warns that a rare, simultaneous bubble in the price of stocks and gold has increased financial risks and the prospect of a significant correction and negative or subdued future returns

Via Talk Markets · December 16, 2025

Tesla Inc (NASDAQ:TSLA) shares raced to new all-time highs on Tuesday with momentum accelerating into the close.

Via Benzinga · December 16, 2025

Google's new deal could serve as a blueprint for the energy industry.

Via The Motley Fool · December 16, 2025

Via Benzinga · December 16, 2025

Via MarketBeat · December 16, 2025

Via Benzinga · December 16, 2025

Unemployment Hits 4.6% in the Latest Jobs Report. What This Means for Wall Streetfool.com

Job seekers didn't get the news they were hoping for on Tuesday. Did investors?

Via The Motley Fool · December 16, 2025

November's delayed jobs report took investors by surprise, sending stocks lower after the unemployment rate rose to 4.6%, the highest since September 2021.

Via Talk Markets · December 16, 2025

Homebuilder Lennar (NYSE:LEN) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales fell by 5.8% year on year to $9.37 billion. Its GAAP profit of $1.93 per share was 12.6% below analysts’ consensus estimates.

Via StockStory · December 16, 2025

For hardly the first time in recent days, investors have become excited about the prospect of a significant change in U.S. drug laws.

Via The Motley Fool · December 16, 2025

Leadership at Warner Bros. intends to formally advise stock owners to turn down the recent bid from Paramount Skydance.

Via Benzinga · December 16, 2025

Growth may mellow out, but the long-term prospects remain strong.

Via The Motley Fool · December 16, 2025

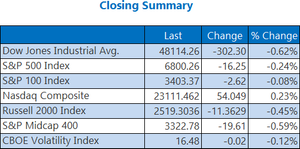

The S&P 500 Index ($SPX ) (SPY ) on Tuesday closed down by -0.24%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed down by -0.62%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed up by +0.26%. December E-mini S&P futures (ESZ25 ) fell...

Via Barchart.com · December 16, 2025

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

Diversified industrial manufacturing company Worthington (NYSE:WOR) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 19.5% year on year to $327.5 million. Its non-GAAP profit of $0.65 per share was 7.7% below analysts’ consensus estimates.

Via StockStory · December 16, 2025

Plug Power and ChargePoint could be potential tenbaggers.

Via The Motley Fool · December 16, 2025

Alphabet's growing market share in AI is a threat to Nvidia's revenue growth.

Via The Motley Fool · December 16, 2025

Explore how sector mix and company size shape the risk and diversification profiles of these two growth-focused ETFs.

Via The Motley Fool · December 16, 2025

Via Benzinga · December 16, 2025

An audience requested battle between four covered call income ETFs.

Via Talk Markets · December 16, 2025

Broadcom's AI growth is impressive. But its latest profit margin message is a reality check for the stock's pricey valuation.

Via The Motley Fool · December 16, 2025

Our top chart expert explains that the best move right now is actually no move at all, according to today’s TTM Squeeze filter results.

Via Barchart.com · December 16, 2025

Booz Allen's CFO is leaving, but is the sell-off an opportunity?

Via The Motley Fool · December 16, 2025

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

Seize on recent weakness with these three undervalued and high-yielding dividend stocks.

Via The Motley Fool · December 16, 2025

Shares of buy-now-pay-later service Sezzle (NASDAQCM:SEZL) jumped 9% in the afternoon session after the company's Board of Directors authorized an additional $100 million stock repurchase program.

Via StockStory · December 16, 2025

Shares of global manufacturing solutions provider Flex (NASDAQ:FLEX) fell 4.2% in the afternoon session after the market reacted to weak U.S. jobs data and persistent concerns over the tech sector. The U.S. government reported that the unemployment rate rose to 4.6% in November, the highest level since 2021. This news added to existing worries about a potential "AI bubble" and prompted investors to sell off technology stocks. The tech-heavy Nasdaq index was particularly affected by this negative sentiment.

Via StockStory · December 16, 2025

Shares of analog chipmaker Microchip Technology (NASDAQ:MCHP)

fell 2.2% in the afternoon session after a broader market downturn and specific weakness in the semiconductor industry overshadowed positive analyst ratings.

Via StockStory · December 16, 2025

Shares of security hardware provider Allegion (NYSE:ALLE) fell 2.4% in the afternoon session after Wells Fargo analyst Joseph O'Dea lowered the company's price target, and the stock traded ex-dividend.

Via StockStory · December 16, 2025

Shares of government consulting firm Booz Allen Hamilton (NYSE:BAH) fell 6.9% in the afternoon session after the company announced that its Chief Financial Officer, Matthew Calderone was resigning. The resignation was set to be effective February 1, 2026. According to a regulatory filing, Calderone informed the company of his decision on December 11, 2025, stating he was leaving to pursue an opportunity outside of the industry. The unexpected change in a key leadership position appeared to unsettle investors. In response to the news, Booz Allen Hamilton began a search for a new chief financial officer.

Via StockStory · December 16, 2025

Shares of interactive software platform Unity (NYSE:U) fell 2.6% in the afternoon session after a director sold over $8.7 million worth of company stock. According to filings, Director Tomer Bar-Zeev sold 175,000 shares. Large stock sales by insiders can sometimes worry investors as they might suggest a lack of confidence in the company's near-term prospects. Further contributing to the sentiment, another shareholder, Anirma Gupta, filed a notice for a proposed sale of 2,167 shares. These insider and shareholder sales created downward pressure on the stock price as the market processed the information.

Via StockStory · December 16, 2025