Latest News

In a landmark move poised to redefine the landscape of cybersecurity, CrowdStrike Holdings, Inc. (NASDAQ: CRWD) announced the general availability of Falcon AI Detection and Response (AIDR) on December 15, 2025. This groundbreaking offering extends the capabilities of the renowned CrowdStrike Falcon platform to secure the rapidly expanding and critically vulnerable AI prompt and agent [...]

Via TokenRing AI · December 16, 2025

The BNY Mellon Enhanced Dividend and Income ETF (BEDY) offers actively managed dividend and derivative income exposure in an ETF wrapper.

Via Benzinga · December 16, 2025

The pipeline always finds its way back to this tech giant.

Via The Motley Fool · December 16, 2025

We find ourselves in a short-term bout of market malaise.

Via Talk Markets · December 16, 2025

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

A monumental breakthrough in artificial intelligence has been announced, as quantum language models (QLMs) have successfully demonstrated generative performance on real quantum hardware. This achievement marks a pivotal moment, moving quantum AI beyond theoretical discussions and simulations into tangible, operational systems. The development signals a significant step towards unlocking unprecedented capabilities in natural language processing [...]

Via TokenRing AI · December 16, 2025

Bitcoin dipped below $86K before stabilizing amid post-jobs volatility.

Via Talk Markets · December 16, 2025

Via MarketBeat · December 16, 2025

Via Benzinga · December 16, 2025

The quest for truly intelligent machines has taken a monumental leap forward, as leading AI labs and research institutions announce significant breakthroughs in codifying human-like rapport and complex reasoning into artificial intelligence architectures. These advancements are poised to revolutionize human-AI interaction, moving beyond mere utility to foster sophisticated, empathetic, and genuinely collaborative relationships. The immediate [...]

Via TokenRing AI · December 16, 2025

Meta stock was higher as the Facebook parent company announced it is launching an app to put Instagram Reels on Amazon Fire TV.

Via Investor's Business Daily · December 16, 2025

Curious about the S&P500 stocks that are in motion on Tuesday? Join us as we explore the top movers within the S&P500 index during today's session.

Via Chartmill · December 16, 2025

The relentless ascent of artificial intelligence is reshaping industries, but its voracious appetite for electricity is now drawing unprecedented scrutiny. As of December 2025, AI data centers are consuming energy at an alarming rate, threatening to overwhelm power grids, exacerbate climate change, and drive up electricity costs for consumers. This escalating demand has triggered a [...]

Via TokenRing AI · December 16, 2025

U.S.

Via Benzinga · December 16, 2025

Here’s how you can keep profiting from an up move in copper prices while protecting yourself on the downside.

Via Barchart.com · December 16, 2025

In a whimsical yet profoundly impactful demonstration of advanced engineering, GE Aerospace (NYSE: GE) has unveiled a groundbreaking project: the design of a high-tech, multi-modal sleigh for Santa Claus, powered by generative artificial intelligence and exascale supercomputing. Announced in December 2025, this initiative transcends its festive facade to highlight the transformative power of AI in [...]

Via TokenRing AI · December 16, 2025

Washington D.C., December 16, 2025 – The United States, under the Trump administration, is embarking on an aggressive and multi-faceted strategy to cement its leadership in artificial intelligence (AI), viewing it as the linchpin of national security, economic prosperity, and global technological dominance. Spearheaded by initiatives like the newly launched "United States Tech Force," a [...]

Via TokenRing AI · December 16, 2025

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

Grayscale expects 2026 to mark a major structural turning point for crypto, driven by rising macro demand for alternative stores of value and long-awaited regulatory clarity.

Via Benzinga · December 16, 2025

The dollar index has been trading around the 100 pivot point since mid-April, with most of its price action below that level. With lower interest rates on the horizon in 2026, it may not be long before the index falls below the first technical suppor...

Via Barchart.com · December 16, 2025

Curious about what's happening in today's session? Check out the latest stock movements and price changes.

Via Chartmill · December 16, 2025

December 16, 2025 – A significant development in the realm of artificial intelligence coding models has emerged from an unexpected source: Reddit. A student developer, operating under the moniker "BigJuicyData," has unveiled the Anni model, a 14-billion parameter (14B) AI coding assistant that is quickly garnering attention for its impressive performance. The model's debut on [...]

Via TokenRing AI · December 16, 2025

Tesla’s U.S. sales appear to have dropped sharply in November, suggesting that the strategy it’s using to combat the expiration of tax credits is not working very well. Meanwhile, Elon Musk’s firm is facing a host of other problems.

Via Barchart.com · December 16, 2025

RALEIGH, NC – December 16, 2025 – In a significant strategic maneuver poised to reshape the landscape of enterprise AI, Red Hat (NYSE: IBM), the world's leading provider of open-source solutions, today announced its acquisition of Chatterbox Labs, a pioneer in model-agnostic AI safety and generative AI (gen AI) guardrails. This acquisition, effective immediately, is [...]

Via TokenRing AI · December 16, 2025

The reality is that the true cost of living in the U.S. has skyrocketed relative to incomes in the U.S. at least since the 1970s.

Via Talk Markets · December 16, 2025

Robot ETFs can electrify your portfolio's gains thanks to their focus on AI chipmakers and physical AI opportunities.

Via The Motley Fool · December 16, 2025

The landscape of artificial intelligence regulation in the United States is rapidly becoming a battleground, as states increasingly push back against federal attempts to centralize control and limit local oversight. At the forefront of this burgeoning conflict is Illinois, whose leaders have vehemently opposed recent federal executive orders aimed at establishing federal primacy in AI [...]

Via TokenRing AI · December 16, 2025

The field of psychology is undergoing a significant transformation as Artificial Intelligence (AI) tools increasingly find their way into clinical practice. A 2025 survey by the American Psychological Association (APA) revealed a rapid surge in adoption, with over half of psychologists now utilizing AI, primarily for administrative tasks, a substantial leap from 29% in the [...]

Via TokenRing AI · December 16, 2025

As of late 2025, the artificial intelligence landscape continues its unprecedented expansion, with semiconductor giants Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) firmly established as the "AI favorites." These companies, through distinct yet complementary strategies, are not merely supplying components; they are architecting the very infrastructure upon which the global AI revolution is being built. [...]

Via TokenRing AI · December 16, 2025

As the trading day approached its midpoint on December 16, 2025, a palpable sense of unease gripped Wall Street, sending major U.S. stock indices into negative territory. Renewed concerns over persistent inflation and the specter of a more aggressive stance from the Federal Reserve have cast a shadow over

Via MarketMinute · December 16, 2025

As of December 2025, the tech stock market finds itself in a period of intense recalibration, grappling with the unprecedented influence of Artificial Intelligence (AI). While earlier in the year, AI-fueled exuberance propelled tech valuations to dizzying heights, a palpable shift towards caution and scrutiny has emerged, leading to notable downturns for some, even as [...]

Via TokenRing AI · December 16, 2025

Robotics ETFs are commanding attention as U.S. policymakers back automation, while EV ETFs remain tied to volatile car demand. Which one can win 2026?

Via Benzinga · December 16, 2025

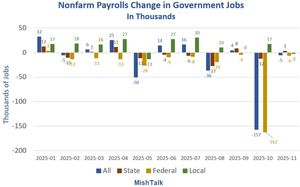

Let’s investigate government jobs, manufacturing, and changes by sector.

Via Talk Markets · December 16, 2025

As 2025 draws to a close and financial markets cast their gaze towards 2026, long-term investors are keenly seeking strategies that promise resilience, growth, and broad diversification amidst an ever-evolving global economic landscape. A compelling recommendation gaining significant traction is the Vanguard Total World Stock ETF (NYSEARCA: VT), a single-fund

Via MarketMinute · December 16, 2025

As 2025 draws to a close, a wave of optimism is sweeping through financial markets, with leading analysts and institutions projecting a strong bullish run for US equities in 2026. The prevailing sentiment, fueled by robust corporate profit outlooks, the transformative power of the artificial intelligence (AI) supercycle, and a

Via MarketMinute · December 16, 2025

Following an on-site factory tour, TalkMarkets author Mark Hake evaluates SenesTech, examining its operations, product economics, and potential path toward recurring revenue and profitability.

Via Talk Markets · December 16, 2025

The global financial markets are navigating a tumultuous period as of December 16, 2025, grappling with a trifecta of significant headwinds: a rapidly weakening labor market, escalating concerns over an "AI bubble," and a dramatic freefall in oil prices. These interconnected factors are collectively reshaping investor sentiment, prompting a reevaluation

Via MarketMinute · December 16, 2025

As the global race for Artificial Intelligence dominance intensifies, the spotlight often falls on groundbreaking algorithms, vast datasets, and ever-more powerful neural networks. However, beneath the surface of these digital marvels lies a physical reality: the indispensable role of highly specialized materials. In late 2025, the establishment of new processing facilities for critical minerals like [...]

Via TokenRing AI · December 16, 2025

New York, NY – December 16, 2025 – U.S. equities are treading water in afternoon trading, with major indices hovering near session lows as investors grapple with a complex web of mixed economic data, intensifying speculation around the Federal Reserve's next moves, and a palpable sense of global market weakness. The

Via MarketMinute · December 16, 2025

In a pivotal move set to redefine the landscape of artificial intelligence in the automotive sector, leading research and development organizations, imec and Japan's Advanced SoC Research for Automotive (ASRA), are spearheading a collaborative effort to standardize chiplet designs for advanced automotive AI applications. This strategic partnership addresses a critical need for interoperability, scalability, and [...]

Via TokenRing AI · December 16, 2025

Tilray Brands shares are in the spotlight Tuesday, surging over 20% amid continued chatter about potential marijuana reclassification.

Via Benzinga · December 16, 2025

The Dow Jones Industrial Average (DJIA) finds itself at a critical juncture in December 2025, having recently scaled unprecedented heights only to face a sudden downdraft that has investors questioning the market's resilience. While the year has largely been characterized by bullish sentiment and record-setting closes, recent economic data and

Via MarketMinute · December 16, 2025

Taiwan stands as the undisputed heart of the global semiconductor industry, a tiny island nation whose technological prowess underpins virtually every advanced electronic device and, crucially, the entire burgeoning field of Artificial Intelligence. Producing over 60% of the world's semiconductors and a staggering 90% of the most advanced chips, Taiwan's role is not merely significant; [...]

Via TokenRing AI · December 16, 2025

Monte Rosa reports interim Phase 1/2 data showing durable responses and manageable safety for MRT-2359 plus Pfizer's Xtandi in advanced prostate cancer patients.

Via Benzinga · December 16, 2025

As the digital age accelerates and artificial intelligence reshapes industries, the demand for electricity in the United States is poised for an unprecedented surge, with projections indicating a staggering 50% increase by 2050. At the epicenter of this energy transformation stands Willdan Group (NASDAQ: WLDN), a professional technical and consulting

Via MarketMinute · December 16, 2025

Realty Income just hiked its dividend as usual, but Wall Street hasn't warmed to its newest initiatives.

Via The Motley Fool · December 16, 2025

In a significant strategic pivot, major financial institutions are aggressively reorganizing their technology banking divisions to seize opportunities within the burgeoning Artificial Intelligence (AI) infrastructure sector. This recalibration signals a profound shift in capital allocation and advisory services, with firms like Goldman Sachs (NYSE: GS) leading the charge to position themselves at the forefront of [...]

Via TokenRing AI · December 16, 2025