Latest News

Via Benzinga · December 16, 2025

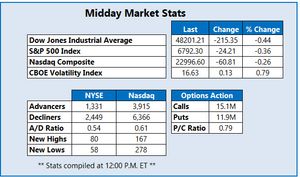

Let's have a look at what is happening on the US markets on Tuesday. Below you can find the stocks with an unusual volume in today's session.

Via Chartmill · December 16, 2025

Oversupply, soft demand, and fading geopolitical risk are dragging crude lower while easing inflation pressure.

Via Stocktwits · December 16, 2025

Interest rates and the U.S. Dollar rendering a verdict on Fed Policy.

Via Talk Markets · December 16, 2025

Apple Has At Least 8 iPhone Models In The Works: Reportstocktwits.com

Via Stocktwits · December 16, 2025

Via Benzinga · December 16, 2025

Via Talk Markets · December 16, 2025

Via Benzinga · December 16, 2025

Natural gas prices are plummeting as the temperatures look for a major rebound from the early Arctic blast.

Via Talk Markets · December 16, 2025

Micron’s upcoming first-quarter results are likely to reflect the strong tailwinds from AI workloads and improving pricing dynamics.

Via Barchart.com · December 16, 2025

Twilio Inc (NYSE:TWLO) shares are trading higher on Tuesday. The company announced a multi‑year partnership with the LA Kings.

Via Benzinga · December 16, 2025

The company now expects full year 2025 guidance of about $62 billion, to the lower end of its previous guidance of $61 to $64 billion and below an analyst estimate of $62.52 billion.

Via Stocktwits · December 16, 2025

Wall Street is once more selling off, this time over a concerning jobs report.

Via Talk Markets · December 16, 2025

Via Benzinga · December 16, 2025

Passive-income investors have an excellent choice with Coca-Cola stock.

Via The Motley Fool · December 16, 2025

Via Benzinga · December 16, 2025

According to a CNBC report, analysts led by Vivek Arya emphasize that the AI trade is still in its early to mid stages, with strong growth potential despite some market fluctuations.

Via Stocktwits · December 16, 2025

Circle shares are rising Tuesday after Visa announced it would allow U.S. institutions to settle transactions using Circle's USDC stablecoin.

Via Benzinga · December 16, 2025

Via MarketBeat · December 16, 2025

Wall Street lacked clear direction on Tuesday, as mixed labor market data failed to ignite a fresh wave of risk-on sentiment.

Via Benzinga · December 16, 2025

UAMY stock tanked 11% on Monday after Korea Zinc announced plans to invest $7.4 billion to build a new smelter in the U.S to produce strategic minerals.

Via Stocktwits · December 16, 2025

WTI crude fell below $55 as rising global supply and weak demand fuel surplus fears Peace talk optimism on Ukraine adds pressure by risking more Russian oil flows Lower fuel prices are easing gasoline costs and could drop further into the holidays

Via Talk Markets · December 16, 2025

Citi slid slightly after signing a multi-year deal to embed LSEG's AI-ready data and workflow tools across the bank.

Via Benzinga · December 16, 2025

Shares of Ford are trending Tuesday after the company announced an adjustment of its electric vehicle strategy and introduced a new battery storage system business.

Via Benzinga · December 16, 2025

Autozi signed large procurement-intention agreement with buyers, targeting vehicles and components worth $980 million.

Via Benzinga · December 16, 2025

FDA approves AstraZeneca and Daiichi's Enhertu combo for first-line HER2-positive breast cancer, while the EU clears Saphnelo self-injection for lupus.

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025

Stay informed about the performance of the S&P500 index in the middle of the day on Tuesday. Uncover the top gainers and losers in today's session for valuable insights.

Via Chartmill · December 16, 2025

Via Benzinga · December 16, 2025

The GBP/USD surges 0.42% on Tuesday as the latest US jobs report revealed the labor mark weakness, while Retail Sales were unexpectedly unchanged from September figures, an indication of consumers’ resilience.

Via Talk Markets · December 16, 2025

Here are the top movers in Tuesday's session, showcasing the stocks with significant price changes.

Via Chartmill · December 16, 2025

Accuray outlines a restructuring plan aimed at $25 million in annual profit gains through cost cuts, workforce reduction and operational realignment.

Via Benzinga · December 16, 2025

Each company has a bullish case, but three stand out as great long-term buys.

Via The Motley Fool · December 16, 2025

Sanmina is growing, but that comes at a cost.

Via The Motley Fool · December 16, 2025

While IDEX Corporation has lagged the broader market over the past year, Wall Street remains optimistic about its prospects.

Via Barchart.com · December 16, 2025

The current momentum should carry Walmart into the 13-figure club.

Via The Motley Fool · December 16, 2025

March NY world sugar #11 (SBH26 ) today is down -0.03 (-0.20%), and March London ICE white sugar #5 (SWH26 ) is down -1.40 (-0.33%). Sugar prices are under pressure today from a slump in crude oil prices. WTI crude (CLF26 ) sank to a 4.75-year low t...

Via Barchart.com · December 16, 2025

Rezolve AI (NASDAQ:RZLV) shares are trading higher Tuesday after the company reported strong preliminary December revenue results.

Via Benzinga · December 16, 2025

Vikram Kamats Hospitality Limited (VKHL), formerly known as Vidli Restaurants Limited, stands as a prominent and dynamically expanding player in the Indian hospitality sector. As of December 16, 2025, the company is keenly in focus due to its aggressive expansion strategies, strategic fundraising, and consistent efforts to enhance operational efficiency. VKHL operates a diverse portfolio, [...]

Via PredictStreet · December 16, 2025

Analysts see Micron’s earnings momentum as a key catalyst, with price targets climbing after Stifel’s upgrade.

Via Barchart.com · December 16, 2025

Real World Assets (RWA) have been floating around the crypto universe since around 2015, with mostly conceptual, early experiments. Only now are investors getting excited about them.

Via Benzinga · December 16, 2025

uniQure shares slid nearly 31% in a month as the FDA raised concerns over whether AMT-130 Phase 1/2 data can support approval.

Via Benzinga · December 16, 2025

The 13F filings for Q3 reveal a split: one side ran for the exits on Tesla and the other poured hundreds of millions into the stock.

Via Benzinga · December 16, 2025

Autozi entered into a Memorandum of Understanding (MOU) covering procurement plans totaling around $980 million.

Via Stocktwits · December 16, 2025

Amazon plans to cut 370 jobs in Luxembourg as part of a broader global restructuring, balancing cost controls with heavy AI and cloud investments amid rising expenses.

Via Benzinga · December 16, 2025

Make sure to set yourself up for success.

Via The Motley Fool · December 16, 2025

A new Counterpoint Research report sees global smartphone sales down in 2026. Here's what that means for Apple.

Via Benzinga · December 16, 2025

Via Benzinga · December 16, 2025